Advertisement

-

Published Date

February 7, 2024This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

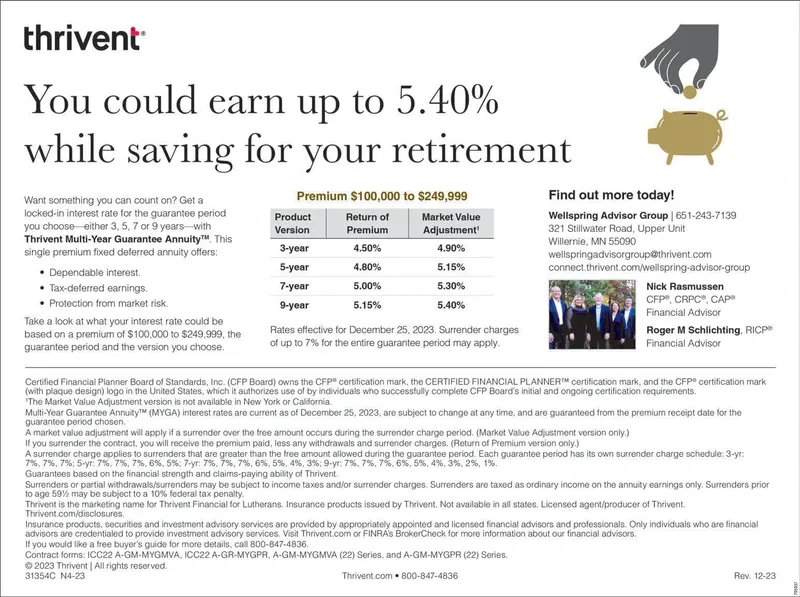

thrivent You could earn up to 5.40% while saving for your retirement Want something you can count on? Get a locked-in interest rate for the guarantee period you choose either 3, 5, 7 or 9 years with Thrivent Multi-Year Guarantee Annuity This single premium fixed deferred annuity offers: Dependable interest. Tax-deferred earnings, Protection from market risk. Take a look at what your interest rate could be based on a premium of $100,000 to $249,999, the guarantee period and the version you choose. Premium $100,000 to $249,999 Return of Market Value Adjustment' Premium 4.50% 4.90% 4.80% 5.00% 5.15% Product Version 3-year 5-year 7-year 9-year 5.15% 5.30% 5.40% Rates effective for December 25, 2023. Surrender charges of up to 7% for the entire guarantee period may apply. Find out more today! Wellspring Advisor Group | 651-243-7139 321 Stillwater Road, Upper Unit Willernie, MN 55090 wellspringadvisorgroup@thrivent.com connect.thrivent.com/wellspring-advisor-group Nick Rasmussen CFP®, CRPC, CAP® Financial Advisor Roger M Schlichting, RICP Financial Advisor Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the CFP® certification mark, the CERTIFIED FINANCIAL PLANNERTM certification mark, and the CFP® certification mark (with plaque design) logo in the United States, which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements. 'The Market Value Adjustment version is not available in New York or California Multi-Year Guarantee AnnuityTM (MYGA) interest rates are current as of December 25, 2023, are subject to change at any time, and are guaranteed from the premium receipt date for the guarantee period A market value adjustment will apply if a surrender over the free amount occurs during the surrender charge period. (Market Value Adjustment version only.) If you surrender the contract, you will receive the premium paid, less any withdrawals and surrender charges. (Return of Premium version only.) A surrender charge applies to surrenders that are greater than the free amount allowed during the guarantee period. Each guarantee period has its own surrender charge schedule: 3-yr: 7%, 7%, 7%; 5-yr: 7%, 7%, 7%, 6%, 5%; 7-yr: 7%, 7 %, 7%, 6%, 5%, 4%, 3%; 9-yr: 7%, 7 %, 7%, 6%, 5%, 4%, 3%, 2%, 1%. Guarantees based on the financial strength and claims-paying ability of Thrivent. Surrenders or partial withdrawals/surrenders may be subject to income taxes and/or surrender charges. Surrenders are taxed as ordinary income on the annuity earnings only. Surrenders prior to age 59% may be subject to a 10% federal tax penalty. Thrivent is the marketing name for Thrivent Financial for Lutherans. Insurance products issued by Thrivent. Not available in all states. Licensed agent/producer of Thrivent. Thrivent.com/disclosures. Insurance products, securities and investment advisory services are provided by appropriately appointed and licensed financial advisors and professionals. Only individuals who are financial advisors are credentialed to provide investment advisory services. Visit Thrivent.com or FINRA's BrokerCheck for more information about our financial advisors, If you would like a free buyer's guide for more details, call 800-847-4836. Contract forms: ICC22 A-GM-MYGMVA, ICC22 A-GR-MYGPR, A-GM-MYGMVA (22) Series, and A-GM-MYGPR (22) Series. 2023 Thrivent | All rights reserved. 31354C N4-23 Thrivent.com 800-847-4836 Rev. 12-23 thrivent You could earn up to 5.40 % while saving for your retirement Want something you can count on ? Get a locked - in interest rate for the guarantee period you choose either 3 , 5 , 7 or 9 years with Thrivent Multi - Year Guarantee Annuity This single premium fixed deferred annuity offers : Dependable interest . Tax - deferred earnings , Protection from market risk . Take a look at what your interest rate could be based on a premium of $ 100,000 to $ 249,999 , the guarantee period and the version you choose . Premium $ 100,000 to $ 249,999 Return of Market Value Adjustment ' Premium 4.50 % 4.90 % 4.80 % 5.00 % 5.15 % Product Version 3 - year 5 - year 7 - year 9 - year 5.15 % 5.30 % 5.40 % Rates effective for December 25 , 2023. Surrender charges of up to 7 % for the entire guarantee period may apply . Find out more today ! Wellspring Advisor Group | 651-243-7139 321 Stillwater Road , Upper Unit Willernie , MN 55090 wellspringadvisorgroup@thrivent.com connect.thrivent.com/wellspring-advisor-group Nick Rasmussen CFP® , CRPC , CAP® Financial Advisor Roger M Schlichting , RICP Financial Advisor Certified Financial Planner Board of Standards , Inc. ( CFP Board ) owns the CFP® certification mark , the CERTIFIED FINANCIAL PLANNERTM certification mark , and the CFP® certification mark ( with plaque design ) logo in the United States , which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements . ' The Market Value Adjustment version is not available in New York or California Multi - Year Guarantee AnnuityTM ( MYGA ) interest rates are current as of December 25 , 2023 , are subject to change at any time , and are guaranteed from the premium receipt date for the guarantee period A market value adjustment will apply if a surrender over the free amount occurs during the surrender charge period . ( Market Value Adjustment version only . ) If you surrender the contract , you will receive the premium paid , less any withdrawals and surrender charges . ( Return of Premium version only . ) A surrender charge applies to surrenders that are greater than the free amount allowed during the guarantee period . Each guarantee period has its own surrender charge schedule : 3 - yr : 7 % , 7 % , 7 % ; 5 - yr : 7 % , 7 % , 7 % , 6 % , 5 % ; 7 - yr : 7 % , 7 % , 7 % , 6 % , 5 % , 4 % , 3 % ; 9 - yr : 7 % , 7 % , 7 % , 6 % , 5 % , 4 % , 3 % , 2 % , 1 % . Guarantees based on the financial strength and claims - paying ability of Thrivent . Surrenders or partial withdrawals / surrenders may be subject to income taxes and / or surrender charges . Surrenders are taxed as ordinary income on the annuity earnings only . Surrenders prior to age 59 % may be subject to a 10 % federal tax penalty . Thrivent is the marketing name for Thrivent Financial for Lutherans . Insurance products issued by Thrivent . Not available in all states . Licensed agent / producer of Thrivent . Thrivent.com/disclosures . Insurance products , securities and investment advisory services are provided by appropriately appointed and licensed financial advisors and professionals . Only individuals who are financial advisors are credentialed to provide investment advisory services . Visit Thrivent.com or FINRA's BrokerCheck for more information about our financial advisors , If you would like a free buyer's guide for more details , call 800-847-4836 . Contract forms : ICC22 A - GM - MYGMVA , ICC22 A - GR - MYGPR , A - GM - MYGMVA ( 22 ) Series , and A - GM - MYGPR ( 22 ) Series . 2023 Thrivent | All rights reserved . 31354C N4-23 Thrivent.com 800-847-4836 Rev. 12-23